The Dilemma of Japan's Corporate Governance

Keywords:

Japan, Economic Governance, Corporate Governance, Balance of PowerAbstract

The internal balance of power sustained by main banks has been a pillar of Japanese corporate governance for decades. Accumulated earnings allow large Japanese firms to remain free from the control of main banks and cause a noticeable change in their corporate governance landscape. In light of the expanding international capital market, Japanese firms are urged to adopt Anglo-American corporate governance standards, which require outside directorship and transparency. However, it is feared that such a standard will undermine the corporate culture of the community firm, with which employees’ career paths and social worlds are integrated. The unwillingness to accept this governance standard amidst the declining role of major banks contributes to a governance vacuum. The norms of organizational loyalty may help prevent the agency problem caused by the imbalance of power before a new equilibrium can be found. However, Japanese corporate governance is still vulnerable to earnings management, strategic traps, imprudent managerial decisions and other mismanagement. It has been proven once before that this can harm Japanese financial institutions.

Downloads

Published

How to Cite

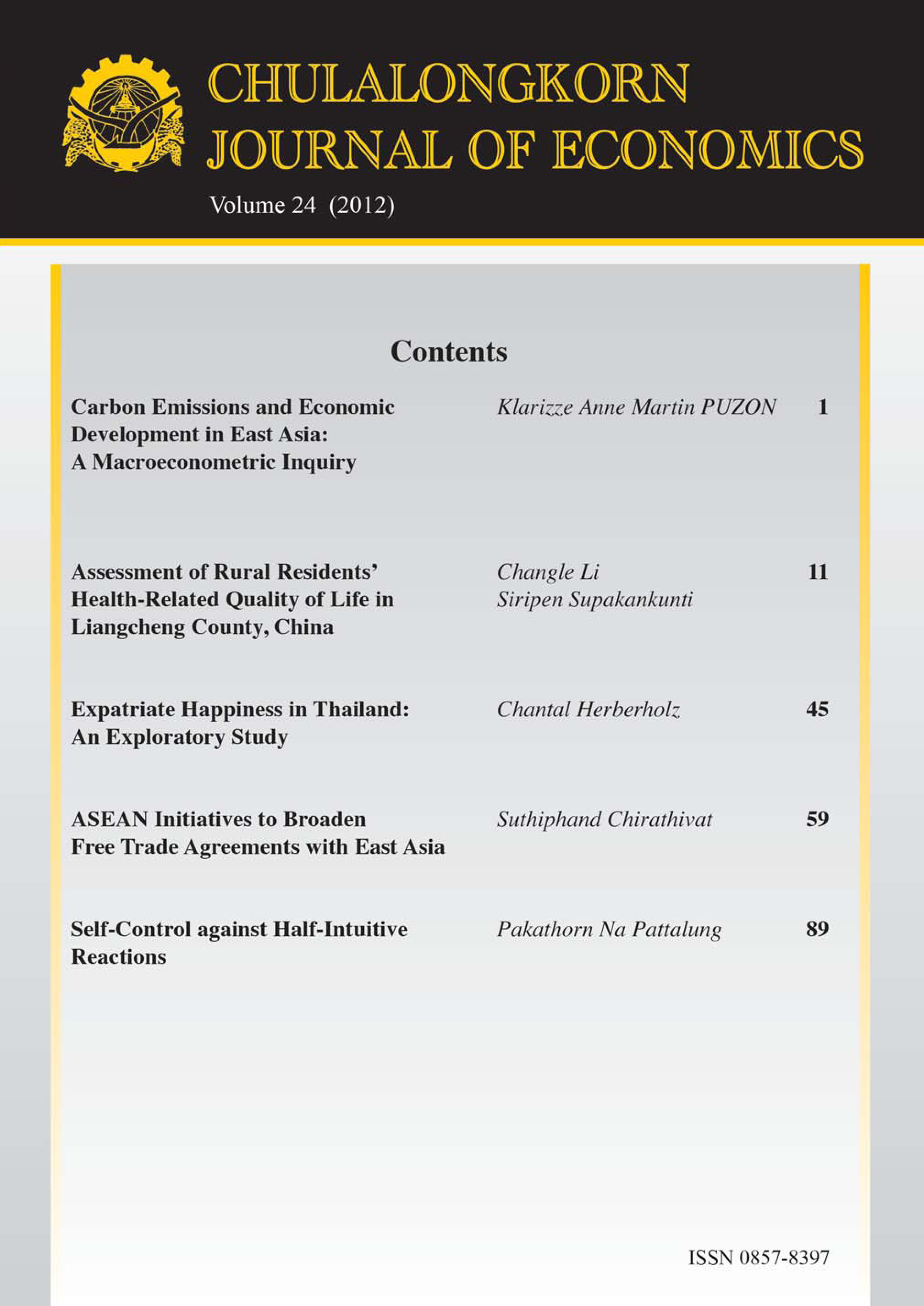

Issue

Section

License

The submission of a manuscript implies that the paper is an original work and has not been published elsewhere. The author(s) authorize the journal to reproduce or distribute the paper in printed or other electronic forms.