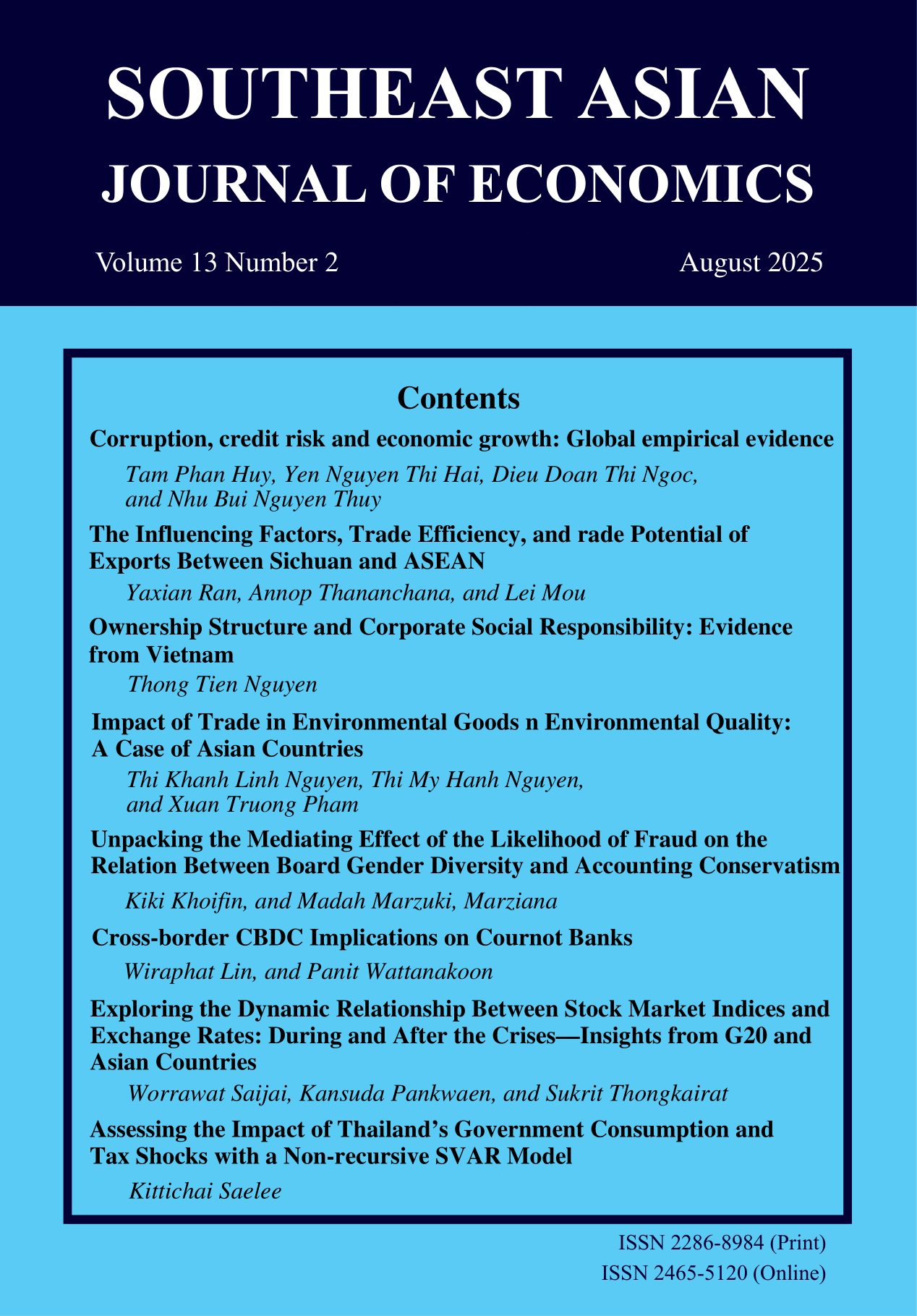

Assessing the Impact of Thailand’s Government Consumption and Tax Shocks with a Non-recursive SVAR Model

Keywords:

fiscal policy, SVAR models, non-recursive identification, business cycles, fiscal multipliersAbstract

In this paper, we linearly quantify the impact of government consumption and tax shocks on key aggregate variables in Thailand. A simple small-open economy SVAR model is developed and estimated with a Thai dataset covering the periods between 2001Q1 and 2023Q1. Both types of fiscal shocks are identified using a non-recursive scheme with some structural coefficients separately estimated from external information. The resulting over-identified SVAR model suggests that fiscal shocks generate short-lived impact on aggregate output and some selected types of private spending. Under the baseline specification, government consumption and tax multipliers are roughly around 0.9 times and -0.7 times, respectively. The response of private consumption to fiscal shocks closely traces the dynamic response of output, whereas private investment is rather insensitive to fiscal shocks. Our key results remain roughly in line across detrending methods applied to the data, thus providing systematically linear evidence that broad-based fiscal multipliers are, at best, moderate in Thailand.

Downloads

Published

How to Cite

Issue

Section

Categories

License

Copyright (c) 2025 SOUTHEAST ASIAN JOURNAL OF ECONOMICS

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

The submission of a manuscript implies that the paper is an original work and has not been published elsewhere. The author(s) authorize the journal to reproduce or distribute the paper in printed or other electronic forms.